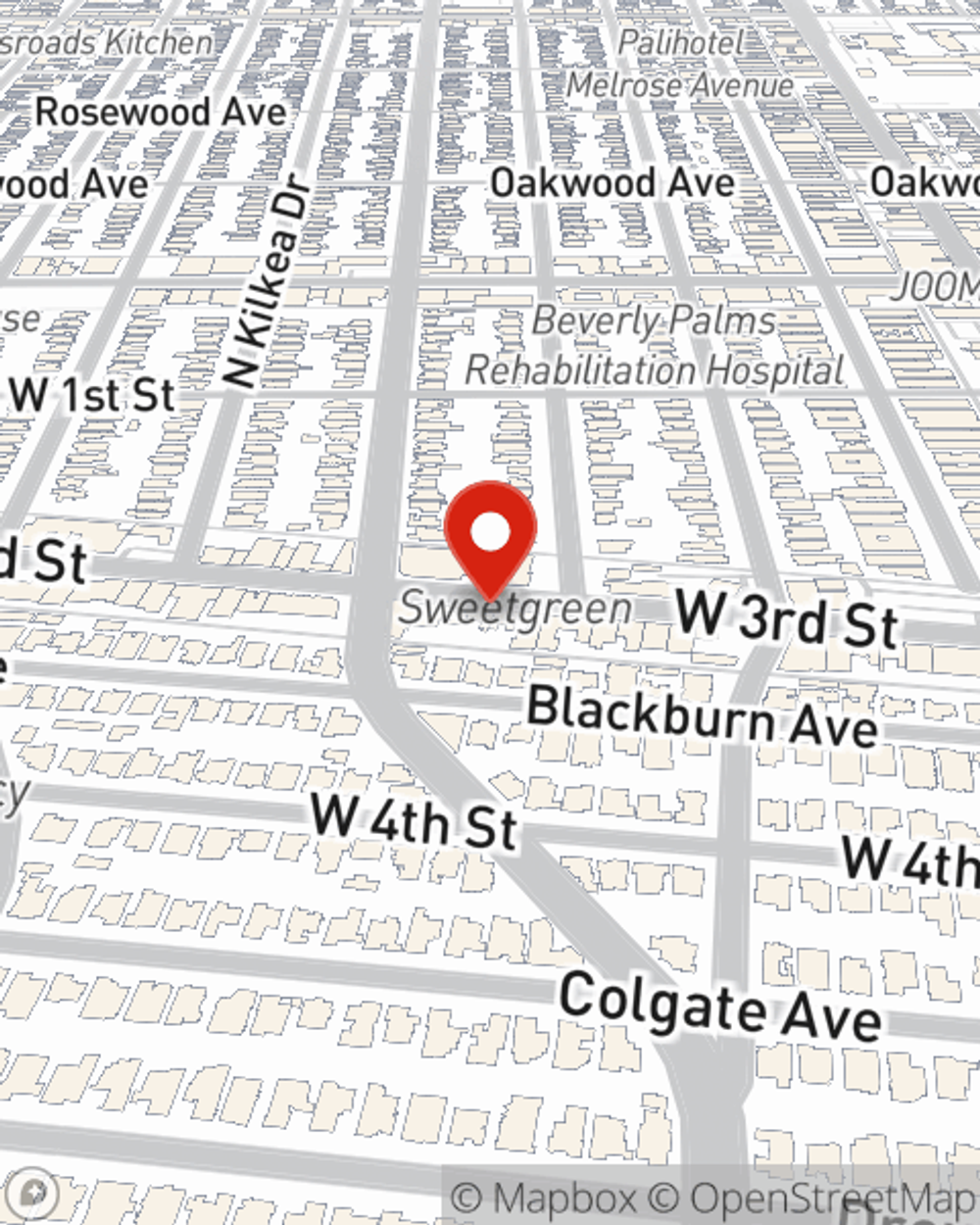

Business Insurance in and around Los Angeles

Los Angeles! Look no further for small business insurance.

Insure your business, intentionally

Business Insurance At A Great Price!

Operating your small business takes time, effort, and terrific insurance. That's why State Farm offers coverage options like a surety or fidelity bond, business continuity plans, errors and omissions liability, and more!

Los Angeles! Look no further for small business insurance.

Insure your business, intentionally

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's an appliance store, a dry cleaner, or a tailoring service, having the right coverage for you is important. As a business owner, as well, State Farm agent Daniel Williams understands and is happy to help with customizing your policy options to fit what you need.

Call Daniel Williams today, and let's get down to business.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Daniel Williams

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.